santa clara property tax rate

Every entity establishes its individual tax rate. Santa Clara County collects on average 067 of a propertys.

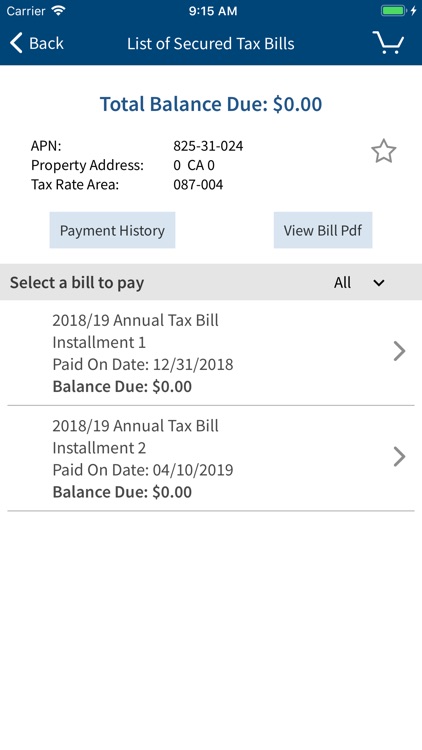

Scc Dtac By County Of Santa Clara

When mailing a payment include the payment coupon and check.

. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. For comparison the median home value in Santa Clara County is. Tax rates can be complicated even without a.

There will also be a transfer tax based on the value of the property and the rate will vary throughout California. The 20222023 Secured Annual property tax bills are expected to be mailed starting October 1 2022. Because of the large number of parcels and frequency of property changing hands in Santa Clara County there are often delays in placing new assessments on the tax roll.

Should you be currently living here. The bills will be available online to be viewedpaid on the. Property taxes are levied on land improvements and business personal property.

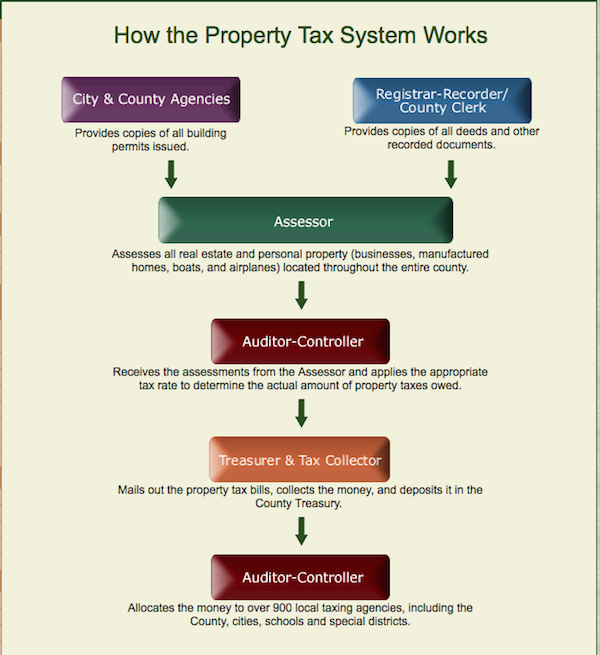

The budgettax rate-setting process typically. The average effective property tax rate in Santa Clara County is 073. The Assessor is responsible for establishing assessed values used in calculating property taxes and maintaining ownership and address information.

Residents of Santa Clara County California pay on average 4694 a year in property taxes. This is an average tax rate of 067 which is below the state average of 074. Learn all about Town Of Santa Clara real estate tax.

The 20222023 Secured Annual property tax bills are expected to be mailed starting October 1 2022. Yearly median tax in Santa Clara County. The bills will be available online to be viewedpaid on the same day.

Department of Tax and Collections. Actual taxes might differ from the figures displayed here due to various abatement and financial assistance programs or to non ad. Other Taxes and Fees.

Nearly all the sub-county entities have agreements for Santa Clara County to bill and collect their tax. For Santa Clara County the rate is 055 per every. The Controller-Treasurers Property Tax.

Proposition 13 the property tax limitation initiative was approved by California voters in 1978. The median property tax in Santa Clara County California is 4694 per year for a home worth the median value of 701000. Whether you are already a resident or just considering moving to Town Of Santa Clara to live or invest in real estate estimate local.

The median property tax in Santa Clara County California is. With our resource you will learn helpful facts about Santa Clara property taxes and get a better understanding of what to anticipate when it is time to pay. The last point is important as Santa Clara Countys government has faced recent criticism for lack of transparency in its tax rate calculations.

San Jose CA 95110-1767. East Wing 6th Floor.

Understanding California S Property Taxes

Property Taxes Department Of Tax And Collections County Of Santa Clara

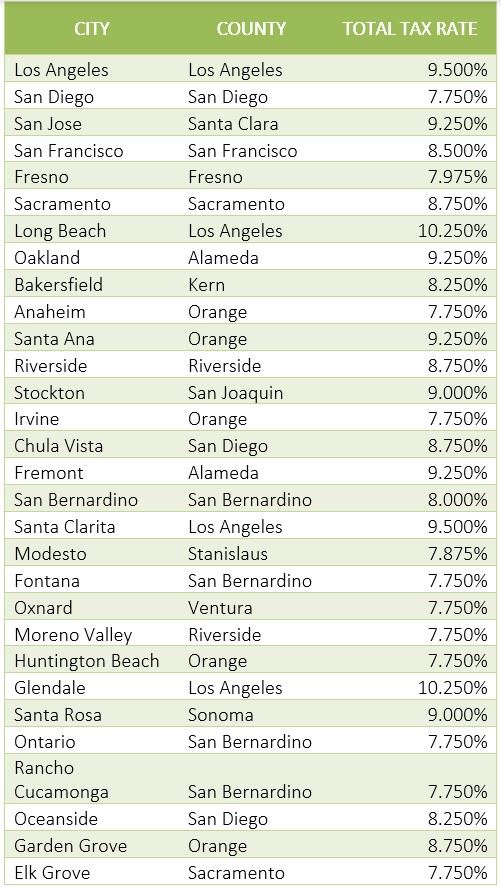

California Sales Tax Guide For Businesses

Property Tax California H R Block

Taxation In California Wikipedia

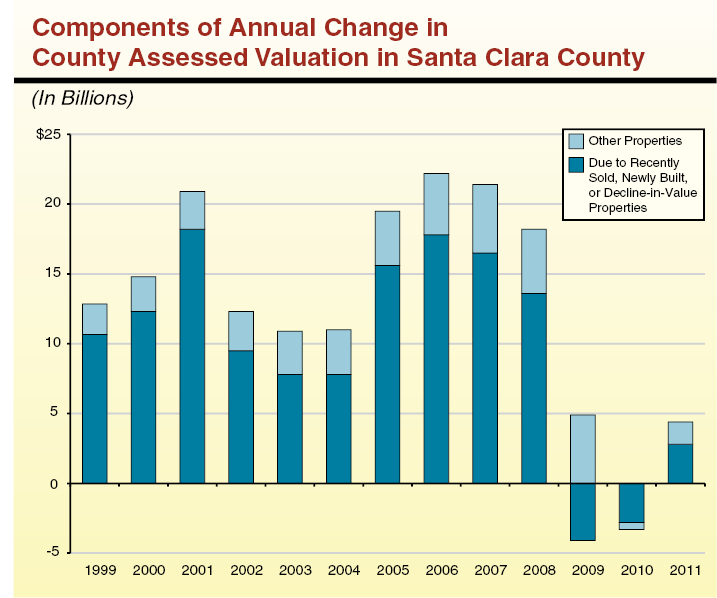

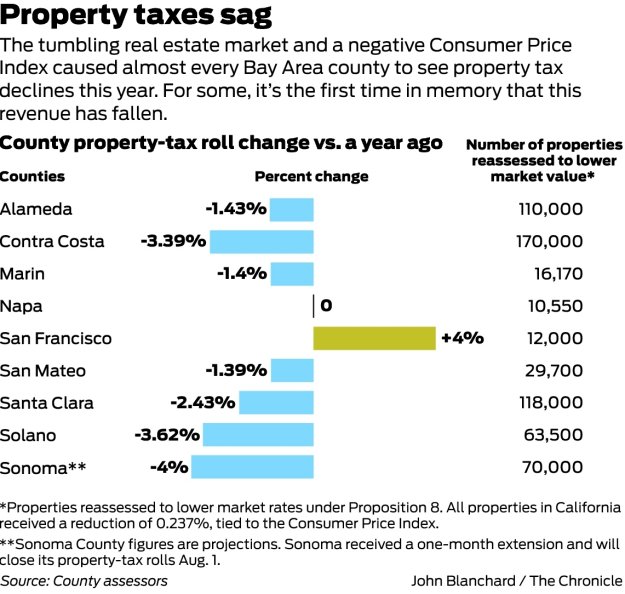

Record Declines In Bay Area Property Taxes

Los Angeles Property Tax Which Cities Pay The Least And The Most

Property Taxes Department Of Tax And Collections County Of Santa Clara

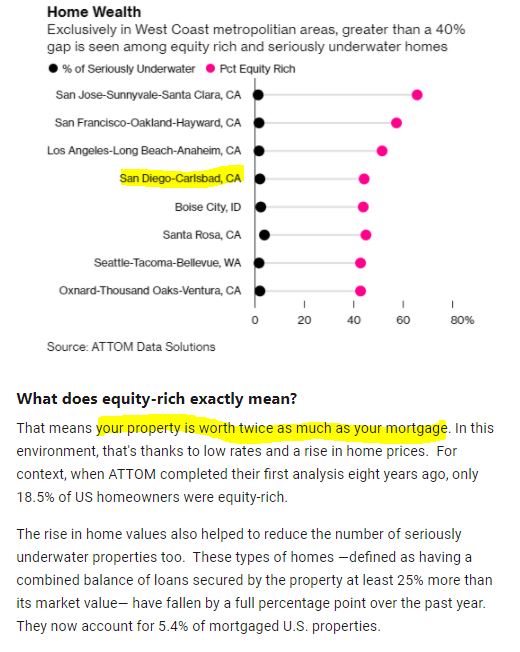

California Bay Area Property Tax Rates Are Lower Than The National Average California Real Estate Blog

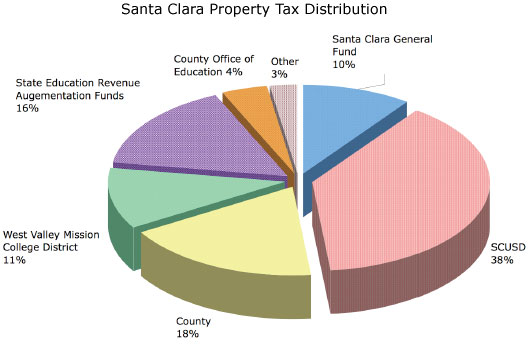

City S General Fund Gets Small Share Of Santa Clara Property Tax Dollars The Silicon Valley Voice

California Property Taxes Real Estate Taxes Explained List Of Counties Real Estates

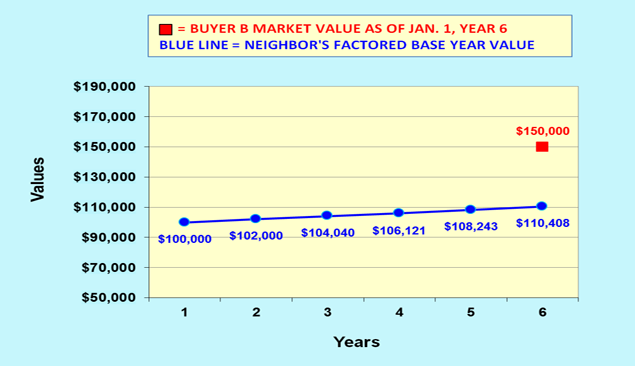

Understanding California S Property Taxes

Santa Clara County Ca Property Tax Calculator Smartasset

How Is Property Tax Calculated In Oregon What Buyers Need To Know Lohr Real Estate

Property Tax Re Assessment Bubbleinfo Com

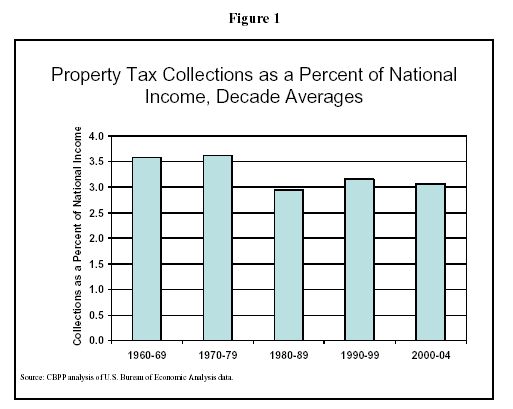

Property Taxes In Perspective Center On Budget And Policy Priorities

By Santa Clara County Controller Treasurer S Office Ppt Download